Saving money is a crucial step towards achieving financial goals. Whether it’s keeping for retirement, a down payment on a house, or a vacation, having a savings plan in place and consistently putting aside a portion of your income is essential. However, many

people struggle with saving enough money to hit their financial goals. In this article, we’ll discuss common reasons why people struggle to save, as well as tips for overcoming

these challenges and reaching your financial goals.

Lack of discipline

One of the main reasons people struggle with saving money is a lack of financial discipline. It’s easy to fall into the trap of spending money on things you don’t need or justify overspending by telling yourself you’ll save more later. Without a solid plan in place and holding yourself accountable to sticking to it, it can be difficult to achieve your savings goals.

Living on Paycheck

Another common issue that can prevent people from saving enough money is living paycheck to paycheck. This can happen when you have a low income, high expenses, or a combination of both. When you’re living paycheck to paycheck, it can be difficult to set aside money for savings as you’re constantly trying to make financial ends meet.

Overspending

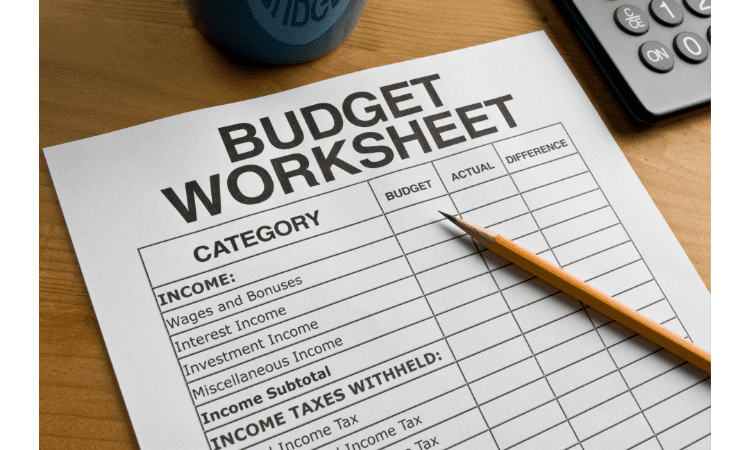

A third common issue is not understanding your expenses. You may think you’re saving money, but not knowing where your money is going can lead to overspending. By creating a financial budget, you can see where your money is going and make sure you’re allocating proper money toward your savings goals.

To overcome these financial challenges and hit your financial goals, there are several strategies you can implement:

Proper Planning

One of the most important is setting a savings goal and creating a plan to reach it. Having a specific goal in mind, such as keeping for a down payment on a house, can help you stay motivated and on track.

Save Regularly

Another key strategy is automating your savings. This can be done by setting up automatic transfers from a checking account to a savings account or by having a portion of your paycheck automatically deposited into your savings account. This can help you save money without thinking about it and avoid the temptation to spend that money on something else.

Track Expense

Another effective strategy for saving money is tracking expenses. By keeping track of where your money is going, you can see where you can cut back and where you can allocate more money toward your financial goals.

Cut your Expenses

Another way to save money is by reducing expenses. You can do this by cutting back on unnecessary expenses, such as eating out or buying expensive clothes, and by shopping around for the best deals on things you do need. Additionally, you can also look for ways to increase your income, such as getting a raise or finding a higher-paying job. Another tip to save money is to negotiate bills and expenses. This can include things like your rent, car insurance, or cable bill. By negotiating your bills and expenses, you may be able to lower your monthly payments and free up money to put toward your savings goals. Additionally, you can also consider cutting back on entertainment expenses. This can include things like going to the movies, eating out, or buying expensive electronics.

You can also consider cutting back on luxury expenses. This can include things like expensive vacations, designer clothing, or high-end cars. By cutting back on luxury expenses, you can free up money to put toward your savings goals.

Set a Budget

Another tip is to set a budget and stick to it. A budget is a great financial tool that can help you understand where your money is going and where you can cut back on expenses. It is important to be realistic when setting the budget and make sure you are not underestimating your expenses. A very effective strategy for saving money is to set up a budgeting system. A budgeting system can help you track your income and expenses, and make sure you’re allocating proper money towards your savings goals. There are many budgeting systems available, such as the 50/30/20 rule, where 50% of your income goes toward necessities, 30% towards wants, and 20% towards savings.

Save for a Wishlist

Another way to reach your savings goals is by creating a savings account for specific goals. This is called “goal-based savings” and it is a great way to save money for specific things like a down payment on a house, a car, or a vacation.

You can also save money by taking a savings challenge. A savings challenge is a fun way to save money by setting a specific savings goal, such as targeting $1000 in one year. By using a savings challenge, you can motivate yourself to save money and reach your financial goals.

know the power of compounding

You can also take advantage of compound interest. Compound interest is when you earn interest on the interest you’ve already earned. This means that the longer you save, the more your money will grow. Consider investing your money in a high-yield savings account or a retirement account, where your money will grow faster than it would in a traditional savings account.

build an emergency fund

Having an emergency fund can help you avoid using credit cards or dipping into your savings when unexpected expenses arise. Setting aside money each month for an emergency fund can help you feel more secure and make it easier to hit your financial goals. You can also set up a savings account specifically for unexpected expenses. This can include things like car repairs, medical bills, or home repairs. By having a savings account specifically for unexpected expenses, you can be prepared for unexpected expenses without having to dip into your savings for your financial goals.

Use Credit Cards wisely

You can also consider using a rewards credit card to your advantage. By using a rewards credit card responsibly, you can earn cash back or points on your purchases. These rewards can then be used towards your savings goals, such as a vacation or a down payment on a house.

stop unnecessary subscription

Another way to save money is by cutting back on subscriptions and memberships. Many people have subscriptions and memberships they don’t use or need, such as gym memberships or streaming services. By cutting back on

these subscriptions and memberships, you can free up money to put towards your savings goals.

Stay Low

You can also consider downsizing your living situation. This can include things like moving to a smaller apartment, getting roommates, or even living in a van or RV. By downsizing your living situation, you can reduce your housing expenses and free up money to put toward your savings goals.

Save on Transportation

Another way to save money is by cutting back on transportation expenses. This can include things like carpooling, biking, or taking public transportation. By cutting back on transportation expenses, you can free up money to put toward your savings goals.

Invest in Government bonds or retirement schemes

Another way to save money is by taking advantage of Government bonds or employer-sponsored savings plans. Many employers offer 401(k) or other retirement savings plans, which can help you save money and reach your financial goals. Additionally, some employers offer other savings plans, such as flexible spending accounts or health savings accounts, which can also help you save money.

It’s important to have a long-term plan for your future savings. This includes planning for retirement, your children’s education, and even for unexpected events such as a health emergency. By planning your future savings, you can ensure that you have proper money to reach your financial goals.

prioritize your expenses

This means identifying the most important expenses, such as housing, food, and healthcare, and allocating the most money toward them. By prioritizing your expenses, you can ensure that you are meeting your basic needs while still being able to save money towards your financial goals.

Use Financial tools or App

You can also consider using a savings app or tool. There are many savings apps available that can help you save money and reach your financial goals. Some apps, like Qapital or Acorns, round up your purchases and transfer the difference to a savings account. Others, like Digit, analyze your spending and automatically transfer money to your savings account.

Conclusion

In conclusion, saving money is an essential step towards achieving financial goals.

However, many people struggle with saving enough money due to a lack of discipline, living paycheck to paycheck, and not understanding expenses. To overcome these financial challenges, it’s important to set a savings goal, create a plan to reach it, automate your savings, reduce your expenses, prioritize your expenses, cut back on luxury expenses, use cash, set up a savings account for unexpected expenses, use rewards credit cards, take advantage of free resources, eliminate unnecessary subscriptions and memberships, use a savings challenge, use savings apps and tools, and use the power of compound interest. By implementing these strategies, you can hit your financial goals and achieve financial security.