Introduction

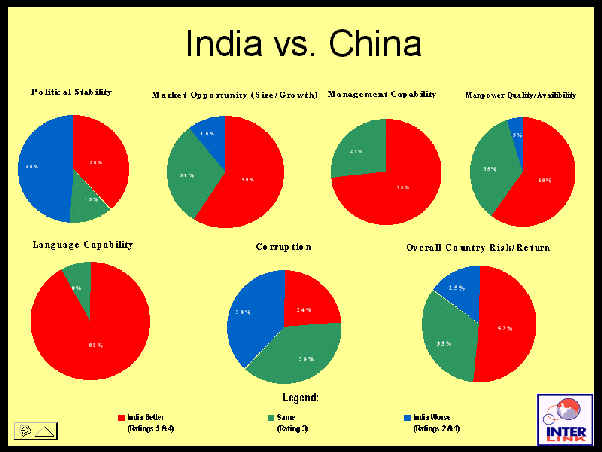

A. Comparison of Indian and Chinese economies

India is now the fifth-largest economy overtaking the United Kingdom. When we talk about the Indian economy, we become extremely optimistic, quoting India as the next economic superpower. But when we compare the per capita income of the top five emerging economies, India is a long way from becoming an economic superpower.

B. India’s potential to become an economic superpower

However, India has shown impressive growth, but it lags behind its rival, China. The history of Asia can be read by comparing the Indian and Chinese economies. According to World Bank figures and chain dollars, in 1980, India’s gross domestic product was 64% of China’s.

By 2001, when China joined the World Trade Organization, India’s economy was only 28% as large as China’s. And despite several years of rapid growth in the 21st century, by 2021, India’s economy had fallen even further behind and equalled only 17% of the Chinese economy.

That’s because China’s GDP growth is always higher than India’s in the past. If India’s economy had kept pace with China over the past 40 years, India would currently have a GDP of $10 trillion instead of $3.47 trillion.

Demographic Advantage and Unemployment

A. Youth unemployment rate

There’s one thing India would beat China’s population. But according to some projections, its workforce will not exceed China’s until mid-century, even though Indians are much younger, India has more than 50% of its population below the age of 25 and more than 65% below the age of 35.

It is the country’s strength as well as its weakness. According to the Center for Monitoring Indian Economy, a private research firm that publishes more recent data than official numbers, the jobless rate has been hovering around 7% or 8%, up from around 5% over the last five years.

B. Labor force participation rate

And according to the CMIE, the labor force participation rate, which includes persons who are employed or seeking employment, has fallen below 40% from 46% six years ago. This chart shows India’s youth unemployment is 40%, much higher than the overall rate of 7.7%.

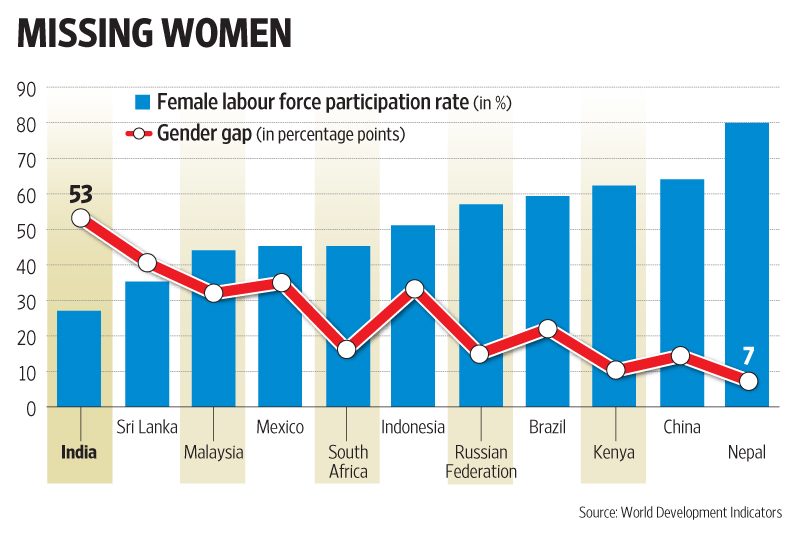

Female Labor Force Participation

If you include household adult women, the rate would be significantly higher. A rise in the female employment rates to the male level would provide India with an extra 235,000,000 workers. This is more than the EU has of either gender and more than enough to fill all the factories in the rest of Asia.

Think about the repercussions. If India rebalanced its workforce in this manner, the IMF believes that the world’s largest democracy would be 27% richer. It is not unusual in developing economies for a family’s social standing to be enhanced by having its women remain at home.

A. Comparison with neighboring countries

But India stands out, as its female labor force participation rate is well below those of countries at comparable income levels. For example, in neighboring Bangladesh, whose customs are not so different from India’s, a boom in garment manufacturing has increased the number of working women by 50% since 2005.

In Vietnam, three-quarters of women work. But the mega factories that boosted female employment there are largely absent in India. The problem is the lack of employment opportunities. The so-called India’s world-beating growth isn’t creating jobs.

B. Potential impact on the economy

A big part of the problem is India’s poor education system and job training, which means local degrees and certificates are often considered worthless by employers. This data shows only 20% of the popular in the age group of 25 to 34 is in highly skilled professions such as medicine, and advanced research with more vocational programs leading to the labor market.

Education and Skill Development

A. Government expenditure on education

India’s youth failed to get skills and education because of its government. The Indian government only spends an average of 2% of its GDP. From primary to postsecondary education, is very low compared to Brazil and South Africa.

B. High-skill professions and vocational training

As India’s government expenditure on education stands at around % of GDP, far below the global average of 4.9%. Additionally, the country faces a significant skill gap, with a lack of vocational training and high-skill professions. To become an economic superpower, India must prioritize education and skill development to create a competitive and skilled workforce.

Healthcare Spending

A. Public expenditure on healthcare

India is also among the countries with the lowest public expenditure on health care at only 1.3% of GDP. India is failing to provide two key components of human development education and health. As a result, labor productivity is declining.

B. Impact on human development

The low expenditure on healthcare hampers human development and overall productivity, with the country ranking 131 out of 189 countries on the Human Development Index.

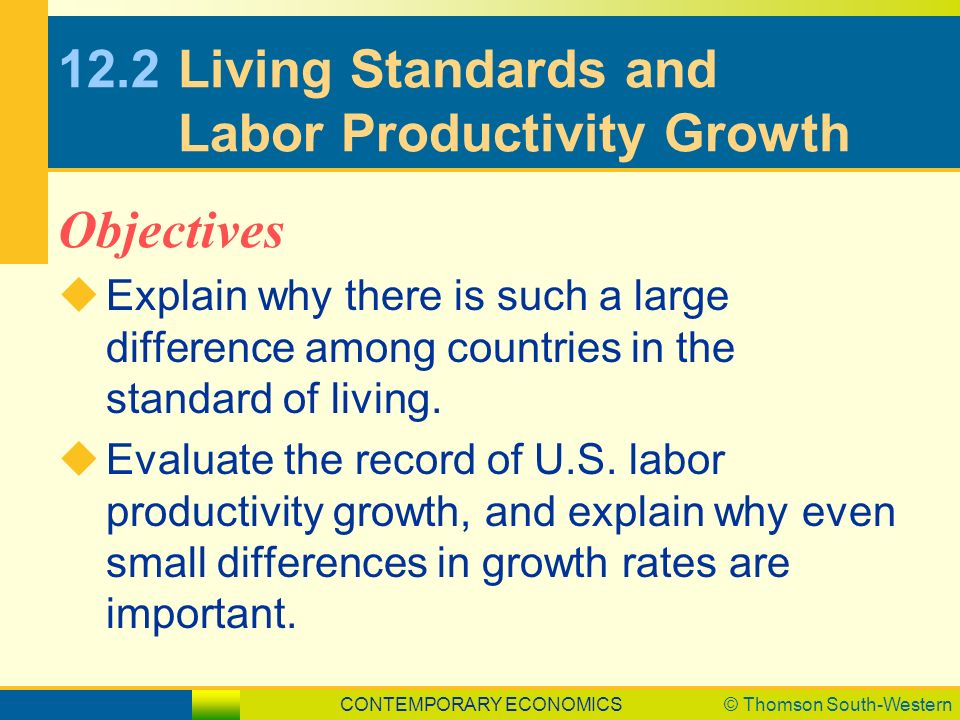

Labor Productivity and Living Standards

GDP per hour worked in comparison with other BRICS countries

Labor productivity is the most important factor for proving the living standards of people in the economy. As an economy’s labor productivity grows, it produces more goods and services for the same amount of relative work.

This increase in output makes it possible to consume more goods and services for an increasingly reasonable price. If we compare the GDP per hour worked of BRICS countries, India has the lowest level of productivity.

India’s labor productivity, measured by GDP per hour worked, is low compared to other BRICS countries. Moreover, living standards in India remain significantly lower than in other emerging economies. This highlights the need for productivity-enhancing measures and improvements in living standards to foster economic growth.

Infrastructure and Investment

A. Comparison with China

China’s productivity took off in 2000 because when its technocrats decide to dam a river, build a road or move a village, the dam goes up, the road goes down, and the village disappears. The displaced villagers may be compensated, but they are not allowed to stand in the way of progress.

China’s leaders make rational decisions that balance the needs of all citizens over the long term. This has led to rapid, sustained growth that has lifted hundreds of millions of people out of poverty. But this is not the case with India. Other structures such as roads and power and public services such as education and drinking water are woefully inadequate in limiting growth.

B. Role of infrastructure in economic growth

India’s top computer scientists are entertained around the world, yet most children in rural areas lack the basic education, needed to find more productive work. A popular argument is that other Asian economies grew by 8-9% for long periods, so why not India? But this East Asian economy invested much more in education and infrastructure than India does today.

Fixed Capital Formation

Factors contributing to the decline since 2007

Regarding infrastructure, the Indian economy has seen unstoppable growth in fixed capital formation, including land improvement, plant machinery, and equipment purchases, and the construction of roads, railways, and commercial and industrial buildings. Still, since 2007, it has fallen from 36% to 29%, several factors that have led to the decrease in fixed capital formation include policy uncertainty, financing problems, weakness in private investment, and a slowdown in the banking sector.

But the most important factor is the fall in foreign direct investment. Since 2008, FDI has fallen from 3.6% to 1.4% of GDP. The government needs to increase the amount of FDI to as much as 6% of the gross domestic product to help spur the economy. It’s important for the government to implement policies and initiatives to attract foreign investors.

Foreign Direct Investment

A. Importance for India’s economy

But the most important factor is the fall in foreign direct investment. Since 2008, FDI has fallen from 3.6% to 1.4% of GDP. The government needs to increase the amount of FDI to as much as 6% of the gross domestic product to help spur the economy. It’s important for the government to implement policies and initiatives to attract foreign investors.

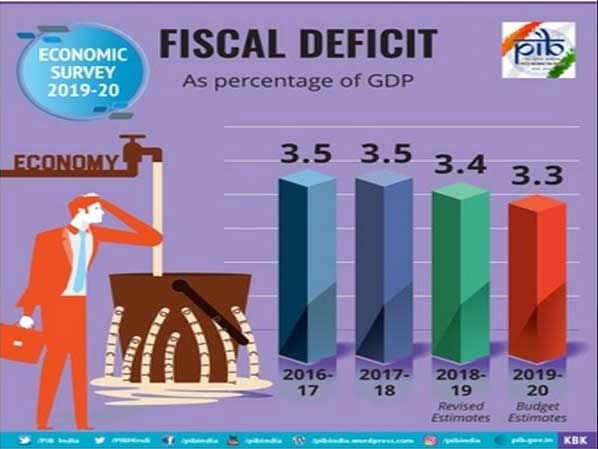

FDI is making it easier to do business, providing tax incentives, and streamlining the investment process. Mr. Narendra Modi could not double the size of the economy to $5 trillion by 2025 while promoting self-reliance and keeping government revenue under pressure. In the last 10 years, the government’s fiscal deficit, which is the difference between the government’s total expenditure and total revenue, has grown. This has led to pressure on the government’s finances and raised concerns about the sustainability of its spending program. The increasing fiscal deficit also impacts the country’s credit rating and borrowing costs. If the deficit continues to grow, it could lead to higher inflation and interest rates, which could further slow economic growth.

B. Government policies and initiatives

Moreover, it could also increase the government’s dependence on borrowing, potentially leading to a higher debt-to-GDP ratio. India’s debt-to-GDP ratio is around 90%. This indicates that the country has a relatively high level of government compared to its economic output. However, India’s debt-to-GDP ratio is not as high as that of some other countries. Credit rating agencies like Moody’s, Standard and Poor’s, and Fitch’s ratings gave India a stable rating, which is considered an investment grade rating. This indicates that the agencies believe that India has relatively low credit risk and a stable outlook for its economy.

Fiscal Deficit and Economic Challenges

A. Impact on government finances

Another crucial area to push forward is exports. According to this report, India’s current account balance widened to the highest in nearly a decade as the nation’s trade gap ballooned and foreign investments fell. The current account, the broadest measure of the country’s overseas trade and service flow, was in a deficit of $36 billion or 4.4% of GDP. India’s current account deficit has been a matter of concern in recent years.

B. Implications for inflation and interest rates

India’s fiscal deficit, the difference between the government’s revenue and expenditure, has been a long-standing concern. A high fiscal deficit can lead to higher inflation and interest rates, adversely affecting private investment and economic growth. To address this issue, the government must strike a balance between spending and revenue generation, focusing on sustainable development.

Debt to GDP Ratio and Credit Ratings

A. Comparison with other countries and Implications for the economic outlook

India’s debt to GDP ratio, at around 90% in 2020, is higher than many other emerging economies. This high level of debt can negatively impact credit ratings and deter foreign investors. To improve its economic outlook, India must work on reducing its debt burden and maintaining fiscal discipline.

Current Account Deficit

A. Trade deficit and import payments

The country faces a persistent trade deficit and increased payments for imports, leading to a widening gap between inflows and outflows. According to the Financial Stability Report, the widened trade deficit reflected the impact of slowing global demand on exports. Although global demand has slowed, India’s consumer demand is rising. This consumer confidence index shows the level of optimism or pessimism among households about the overall state of the economy and their personal financial situation. It is typically calculated based on surveys of a representative sample of households, in which they are asked about their views on current and future economic conditions, employment prospects, and their spending and saving patterns.

B. Impact of slowing global demand

India’s current account deficit, the difference between the value of imports and exports, has historically been a challenge. A high trade deficit and large import payments can put pressure on the country’s foreign exchange reserves and exchange rate. Additionally, slowing global demand can further exacerbate these issues, highlighting the need for India to diversify its export markets and promote domestic industries.

Consumer Confidence and Consumption

A. Consumer Confidence Index

The index is used as an indicator of consumer spending, which is an important driver of economic growth. Consumption may rise further as inflation falls, and Indians purchasing power rises. But capital spending and manufacturing are what really matter, they boost current growth and the economy’s potential. Signing for the world market has not been India’s strong suit, rickety infrastructure, expensive and unreliable electric power, complicated labor and land laws, and a frustrating bureaucracy prevented India.

B. Role in economic growth

A robust Consumer Confidence Index can propel economic activity and improve overall growth prospects. The government must continue to focus on policies that boost consumer confidence, such as reducing inflation and increasing employment opportunities.

India’s Competitiveness in the World Market

A. Challenges faced in industrialization in comparison with other Asian economies

From joining previous waves of Asian industrialization, Japan, South Korea, Taiwan, Singapore, Vietnam, and of course China all outperformed India in the race to industrialize. Today, however, a confluence of international and domestic factors is giving India a chance to catch up. Internationally, manufacturers are looking to reduce their dependency on China. Domestically, the populist government of Prime Minister Narendra Modi wants broader prosperity than the cyber economy on its own can provide.

Potential for Catching Up

A. Importance of investing in human capital and reforms

Years of investment in highways, railroads, and ports combined with regulatory reforms have reduced, if not eliminated, the obstacles that long kept foreign investors at bay. Investing in human capital can also help address several other challenges facing India, such as the need for a more skilled and productive workforce, and the challenge of creating decent jobs for the growing population. Education and training are critical to the long-term growth and competitiveness of the Indian economy. A well-educated and skilled workforce is essential for attracting investment, promoting innovation, and increasing productivity. To achieve these goals, the government must allocate more educational resources and prioritize them in its budget and policy making.

Overall, reforming the education system and increasing investment and human capital is crucial for India to become a leading global economy and ensure a better future for its citizens.

Conclusion

A. The need for reforms and increased investment

In conclusion, India has immense potential to become an economic superpower, given its vast population, demographic advantage, and growing middle class. However, to achieve this status, the country must address various challenges, including unemployment, education, healthcare, infrastructure, and fiscal discipline. By implementing reforms, increasing investment, and fostering a business-friendly environment, India can overcome these obstacles and emerge as a leading global economy.

India’s journey toward becoming an economic superpower is a complex and multifaceted one. Tackling the challenges in education, healthcare, infrastructure, and fiscal management is vital to ensure sustainable and inclusive growth. Additionally, it is essential to create a favorable environment for businesses and industries to prosper and attract foreign investment.

To accomplish these goals, India must focus on strengthening its institutions, streamlining regulations, and promoting transparency. These measures will not only help attract FDI but also foster domestic investment and entrepreneurship. Furthermore, empowering women and increasing their participation in the workforce can unlock the country’s full economic potential.

In the international arena, India must continue to engage with global markets and develop strategic partnerships that benefit its economy. By diversifying its export markets, India can mitigate the risks associated with fluctuations in global demand and strengthen its foreign exchange reserves. Additionally, the country must maintain a stable macroeconomic environment, characterized by low inflation, manageable fiscal deficits, and a healthy debt-to-GDP ratio.

B. The potential for India to become a leading global economy

Finally, India’s path to becoming an economic superpower depends on its ability to invest in its people. Providing quality education and skill development opportunities, improving access to healthcare, and ensuring social equity is crucial for building a healthy and productive workforce. By investing in human capital and driving sustainable development, India can make significant strides toward achieving its economic potential.

In summary, India’s path to becoming an economic superpower is laden with challenges and opportunities. Through concerted efforts, targeted reforms, and increased investment in infrastructure, human capital, and innovation, the country can overcome these obstacles and claim its rightful place as a leading global economy. The journey may be long and arduous, but with determination, resilience, and foresight, India can undoubtedly achieve its economic aspirations.